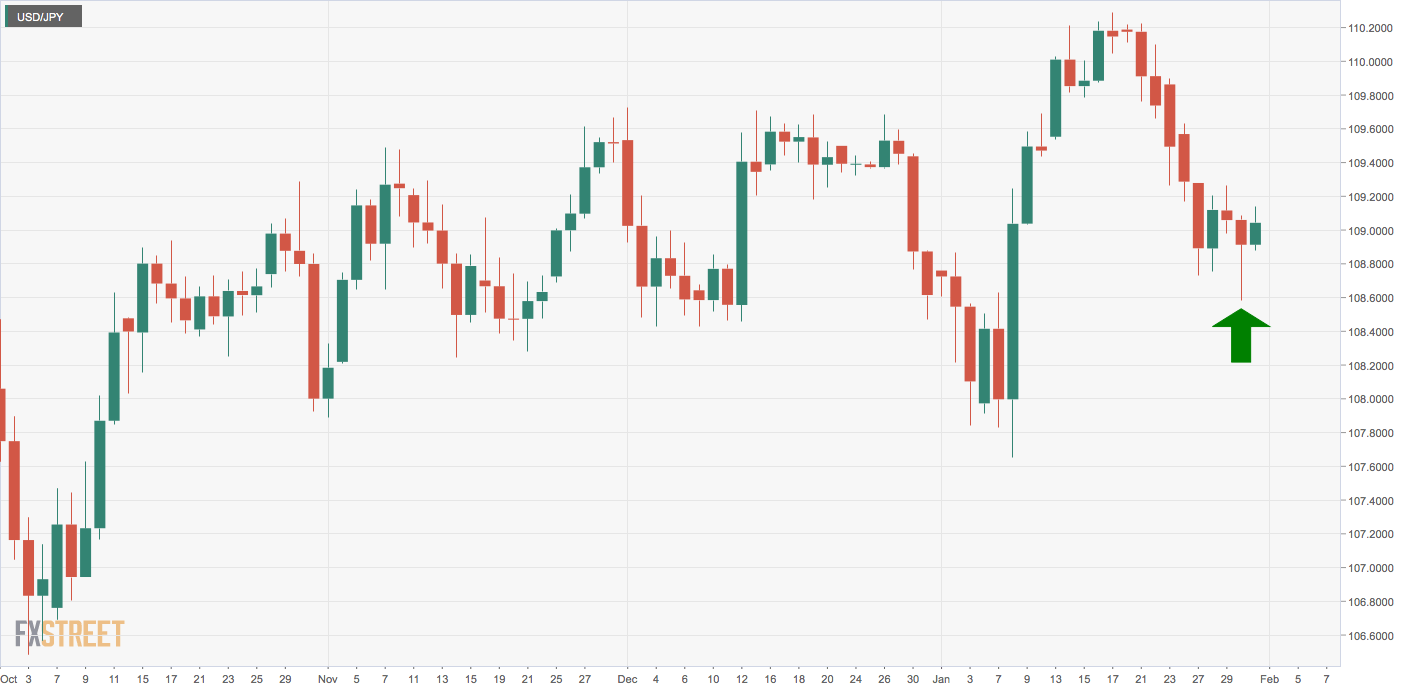

USD/JPY Price Analysis: Hammer hinting at bullish reversal

- USD/JPY charted a long-tailed hammer candle on Thursday.

- A strong follow-through on Friday is needed to confirm bullish reversal.

USD/JPY is currently trading at 109.03, representing a 0.10% gain on the day, having hit a high and low of 109.35 and 108.88, respectively.

The pair is looking to post a bullish follow-through to the classic long-tailed hammer candle created on Thursday. That candle is widely considered an early sign of bullish reversal, the trend change, however, requires confirmation from a successive up-day

Put simply, a bullish reversal would be confirmed if the pair prints a close above 109.06 on Friday. That would open the doors for a rise to resistance at 109.70.

On the other hand, if the pair fails to close above 109.06, the pair could see consolidation. Meanwhile, a close below Thursday’s low of 108.58 would expose the Jan. 8 low of 107.65.

Daily chart

Trend: Teasing bull reversal

Technical levels