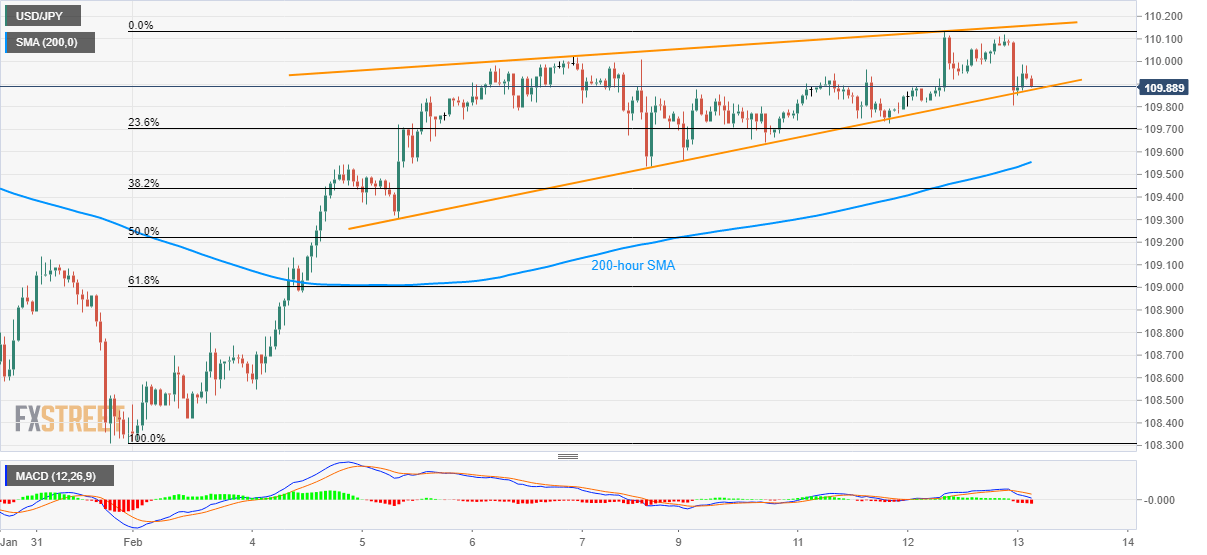

USD/JPY Price Analysis: Rising wedge on hourly chart keeps sellers hopeful

- USD/JPY steps back from three-week high while forming a bearish technical pattern.

- Sellers await confirmation to take aim at 200-hour SMA, January-end top.

- An upside clearance of Wednesday’s top needs validation from January high.

USD/JPY makes rounds to 109.90 while heading into the European session on Thursday. The pair recently declined from multi-day high, which in turn portrays a short-term bearish technical formation on the hourly chart.

Even so, sellers will need a sustained break below the pattern’s support of 109.80 to test a 200-hour SMA level of 109.55 and January 31, 2020 high of 109.13.

If at all MACD continues to flash bearish signals past-109.13, 108.60 and the monthly bottom around 108.30 will return to the charts.

Meanwhile, an upside break of Wednesday’s top needs to cross the pattern resistance of 110.20 and January 17 high of 110.30 to defy the bearish signals.

In doing so, buyers can take aim at May 2019 top surrounding 110.70.

USD/JPY hourly chart

Trend: Pullback expected

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com